What is volatility? This term carries a double meaning. It is used as a description of significant price movements, and also as a description of the propensity of the underlying asset to undergo said movements.

The very concept of volatility is very often found not only in specialized literature . Thanks to the rapid growth of interest of the “broad masses” in stock trading, terminology and trading slang can be heard even in everyday conversations.

But do we all fully understand the meaning of this term and are able to answer the question: “What is volatility?”

Volatility of currency pairs

The volatility of currency pairs , like any other asset, is characterized by the number of points by which the price of an asset changes over a certain period of time. This characteristic varies greatly for different trading instruments. For Forex traders, this characteristic is especially important, since the global foreign exchange market is much more dynamic than other markets. Forex volatility is the subject of serious research. But the results of these studies, in most cases, only allow us to state facts that have already happened and, with varying degrees of error, systematize trading instruments according to this criterion.

But this approach does not protect traders from errors in calculations. The fact is that the volatility of any currency pair can change significantly during not only the trading day, but even during one trading session .

The so-called volatility calendar , which can be compiled based on the above-mentioned studies, is also nothing more than advisory in nature, because Even the GBP/JPY pair, known for its “swinging gait,” which received the nickname “dragon” precisely for its high volatility, can demonstrate “meekness” and move no more than 50 points during a trading session.

Volatile pairs - pairs whose price fluctuations during a trading session can reach 200-300 points, are very popular among currency market speculators and binary options market operators. Trading such instruments promises the trader high profits. But we must not forget that the degree of risk in such operations is very high. Obviously, in such conditions, a clear understanding of the level of volatility of a trading instrument is very important.

The currency pair volatility indicator is a very important technical analysis tool. They can have different software implementations and are included in the basic configurations of all known trading platforms.

One of the standard indicators for measuring volatility is the ATR indicator. It allows you to measure automatic price changes in points for a certain amount of time, which is set in the indicator settings. In the figure below, the period “14” is selected, which means that the volatility of the currency pair is measured over fourteen periods, or, more simply, candles.

In our case, we have a minute timeframe , which means volatility is measured in 14 minutes using the Average True Range indicator. If you select an hourly timeframe, you will be able to see the volatility of the EUR/USD currency pair over 14 hours. In the settings you can always change this value to any other.

The choice of a specific software product is a personal matter for each trader. Here is one of the popular Mataf volatility calculators.

Volatility calculator

As already mentioned, volatility calculators can have different forms, but the algorithm for their functioning, i.e. their calculation methodology is the same. These software modules calculate the following indicators for the selected trading instrument:

- Average volatility for a user-specified period (default 8-10 weeks);

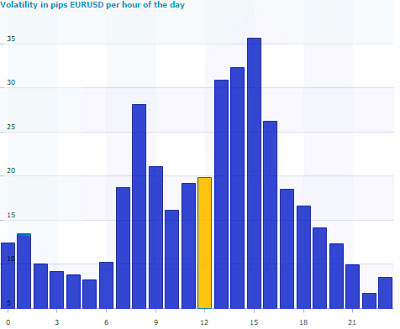

- Hourly volatility indicator for the last trading day;

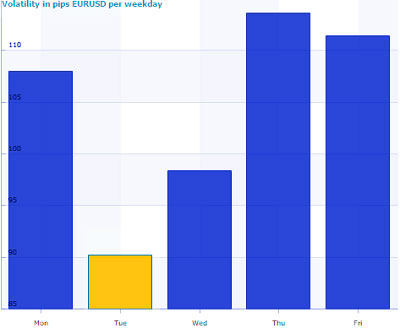

- Average hourly rate for a specific day of the week;

- Five-year chart of trading instrument volatility.

The breadth of the sample of incoming information allows us to say with a high degree of confidence that the indicators calculated by the calculator accurately reflect the real picture.

But even so, unconditional use of the obtained indicators is very risky. Peace, incl. financial, does not stand still. It is very difficult to predict currency price changes (at least their range) based on retrospective information.

In practice, volatility indicators of a trading instrument are used in strategic planning, as a rule, at the stage of selecting the underlying asset for trading. For example, pairs with high volatility are not recommended for use by beginners in stock trading.

Also, the volatility indicator must be taken into account when choosing a trading strategy. For example, during periods of high volatility, high profitability can be provided by scalping strategies for binary options - “ Night trading ”, “ Hubba Hubba Style ”, etc. Currency pairs with low volatility make sense to use for hedging and trading with minimal risk (even with low profitability).

But no matter what instruments and what strategies are used for trading, we should not forget about the volatility of the volatility indicator.

Conclusion

If we talk about trading binary options, then volatility should be taken into account only for those trading systems that require volatile markets. In other cases, the volatility of currency pairs is more important for the Forex market, since it can be used to calculate the size of the stop loss or the approximate value of the movement of a trading asset per day, which is of little importance for binary options, since profits depend on time, and not from range of motion. But if you use exotic types of binary options , then volatility must be taken into account, since in such options trading is most often carried out in a range and not only time, but also price is important.

See also:

How to choose a binary options broker?

To leave a comment, you must register or log in to your account.