Positive Martingale (Anti-Martingale) refers to a strategy limited to three transactions, providing for a gradual increase in rates, provided that the transactions are profitable. Below you will find a ready-made online calculator for calculating a trade using this strategy.

The use of this system can significantly reduce the risk of losing a deposit.

To work with this strategy, you need to determine:

- the size of the initial investment;

- percentage of payments for each option;

- level of risk for each transaction.

The size of the initial investment corresponds to the level of risk that the trader is willing to take when making transactions. In particular, if you have $100 in your broker account, then it is optimal to enter a deal with $5. Accordingly, the trader can lose no more than the specified amount.

The total investment volume for the second transaction within the framework of the strategy under consideration is equal to the size of the initial transaction and 80% of the profit received earlier. Let's say the option yield was 70%. The first transaction (taking into account that $5 was invested) brought in $3.5. This means that the next operation will require 7.8 dollars (3.8 * 80 + 5). As a result, 20% of the amount earned through the first transaction remains on the deposit.

If the contract did not bring profit, then you need to return to the first step. That is, invest $5 in the next trade.

To open the third contract, you will need half the amount received in the previous two operations. That is, you need to add 3.5 (received thanks to the first transaction) and 5.46 (received after the second transaction) dollars and divide the resulting number by two. The result will be $4.48, which can be invested in the third contract.

As a result, even if the last transaction brings a loss, the deposit will be replenished by half of the previously received profit. If the third contract is unsuccessful, you need to return to the first step and open a position with 5 dollars. All calculations can be done automatically using the AntiMaringale online calculator.

Online calculator for calculating Anti-Martingale

| Initial deposit: | ||

|---|---|---|

| Payout percentage: | ||

| Risk per trade in %: | 5 % | |

| Available deals: | 20 | |

| First trade: | Size: Potential profit: | 5 3.5 |

| Second deal: | Trade size if 1st trade is in profit: ...if in the red: Total potential profit: Profits already received: | 7.8 5 6.16 0.7 |

| Third deal: | Trade size if the 2nd trade is in the black: ...if in the red: General sweat. profit: Profits already received: | 4.48 5 12.1 4.48 |

How to use the Anti-Martingale calculator:

When starting to work with the calculator, you need to decide and indicate the size of your deposit and the percentage of payments for the asset you are trading with the broker. After this, you should enter the risk parameters for the transaction. The calculator will immediately show the maximum possible number of unprofitable transactions that your deposit can withstand.

Working with the AntiMartingale strategy consists of three simple steps. The risk per transaction is set at 1-10%. When choosing a percentage, you should definitely take into account that the maximum losing streak according to your trading strategy; the purely available transactions should exceed this value. If the transaction brings profit, the bet size increases by an amount equal to the initial bet and 80% of the profit received (for example, your bet was $5 and the broker’s payout percentage for the option was 70%, then 5 + 3.5*80%= $7.8). If the second trade results in a loss, you need to return to the original trade size. If the second trade makes a profit, then we enter the third trade with an amount equal to half the profit received from the first two bets. After the third deal, the rate returns to the original one.

More information about the Anti-Martingale system:

In the field of gambling, this strategy is better known as Parlay systems. The meaning of this approach is that the size of the investment doubles when the transaction brings the desired profit. In case of loss, a return to the original bet follows. This approach allows you to build up capital relatively quickly and reduce losses.

Using this strategy when working with binary options, you can get a good income, provided that the operations are carried out during a pronounced trend. For trading to be profitable, you must make at least three break-even transactions. Anti-Martingale is considered a more secure system than Martingale, but it generates less income.

Yield table for payments of 80%

Bid | 10 | 20 | 10 | 20 | 10 | 20 | 40 |

Profit | 8 | 8 | 8 | 16 | 32 | ||

| Lesion | -20 | -20 | |||||

In total | 8 | -12 | -4 | -24 | -16 | 0 | 32 |

Despite the fact that Anti-Martingale is a more secure system, the possibility of losing a deposit remains. At the same time, working with this strategy is easier from a psychological point of view. It is important to understand that there are no absolutely break-even strategies. Anti-Martingale can only reduce the risk on each trade. The main thing is that in the end the number of profitable operations exceeds the number of unprofitable ones.

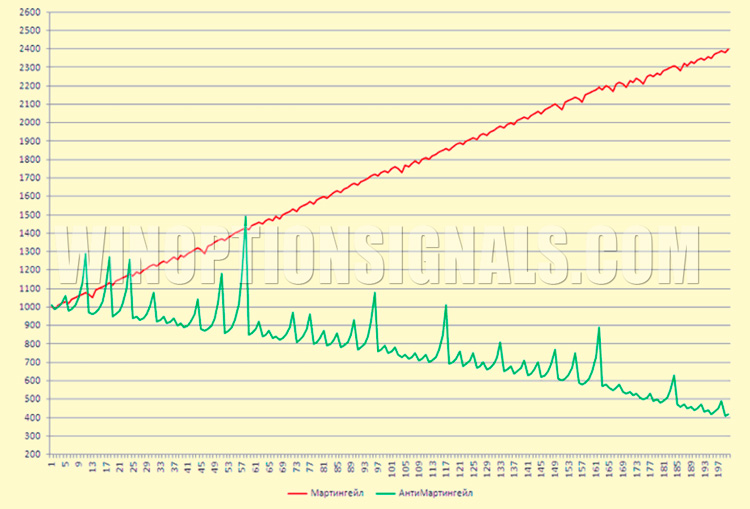

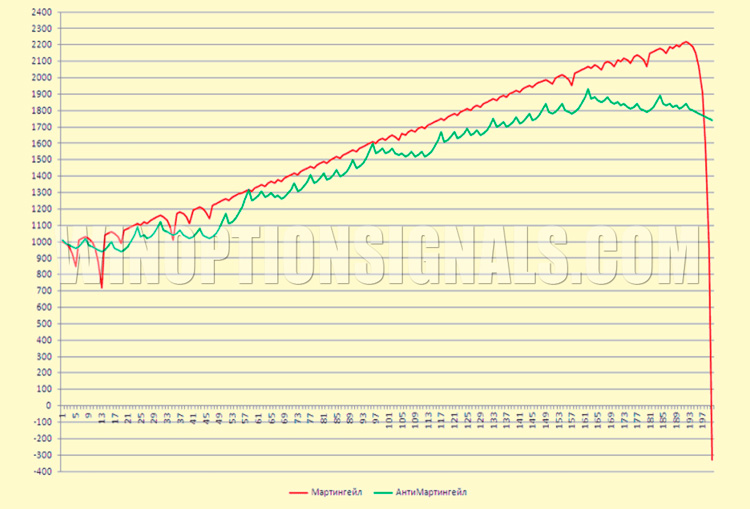

The above graph shows the deposit size curves obtained over 200 transactions. The red line shows trades made using Martingale, and the green line shows Anti-Martingale. Looking at the green line, you can see that the last few trades have resulted in losses.

The development of such a situation can be avoided by correcting the chosen strategy: using an arithmetic progression instead of a geometric one. In other words, the size of the next bet increases by the amount of the initial one. The table shows what can be achieved within the given strategy.

Bid | 10 | 20 | thirty | 40 | 50 | 60 | 10 |

Profit | 8 | 16 | 24 | 32 | 40 | ||

Lesion | -60 | ||||||

In total | 8 | 16 | 24 | 48 | 80 | 120 | 60 |

This chart shows that by correcting the Anti-Martingale system, in unfavorable conditions it is possible to keep the line within one level or allow a slight decrease in profitability, while trading using the Martingale system in such a situation would completely drain the deposit.

For all these seemingly complex calculations, it is better to use a ready-made online rate calculator.

Each of the above strategies has supporters and opponents. However, if you regularly use suitable trading signals, then Anti-Martingale will turn out to be a safer system than Martingale.

See also: Martingale calculator

To leave a comment, you must register or log in to your account.